For working-class home buyers in Mumbai, there aren’t too many…

For working-class home buyers in Mumbai, there aren’t too many…

I cannot help but feel puzzlement at Air India’s sudden decision not to rent out space in what is one of the most valuable real estate assets in the financial capital of Mumbai.

The Indian rental housing sector is seriously under-serviced by the organized real estate industry.

Over the last six to seven years, the number of investors who enter the residential real estate sector for the purpose of capital appreciation has been increasing.

After recording significant leasing in 4Q10, Mumbai city witnessed moderate transaction activity in 1Q11 as the major office occupiers of India Inc awaited the impact of budget on their corporate real estate strategy for the next fiscal year.

The period ending 1Q11 witnessed moderate activity in the office market in the city. With CBD vacancy rates continuing to hover at around 1%, office transactions were limited to either small office queries or larger office spaces that were inevitably a churn in the existing stock.

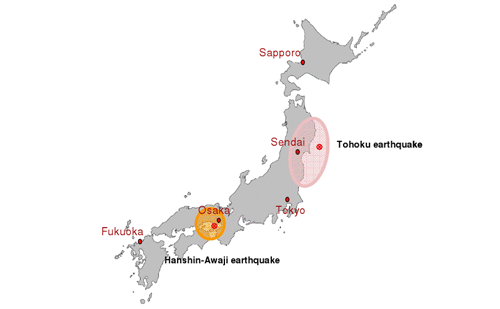

On 11 March, a major earthquake and tsunami hit Eastern Japan. According to official statistics, the number of deceased had surpassed 13,000 as at 14 April.

The Sensex has always been a barometer of the country’s general economic ‘mood’. The real estate index, on the other hand, is an indicator of the sentiments towards real estate developers.

According to the 2010 census, Mumbai now houses around 14 million people, which makes it India’s most populous city and the world’s second-most populous city.

After a one-year period starting 3Q 2009, which saw a strong recovery with a record 40%+ increase in prices, the Mumbai residential real estate market has been seeing a slowdown over the last two quarters across various micro markets.