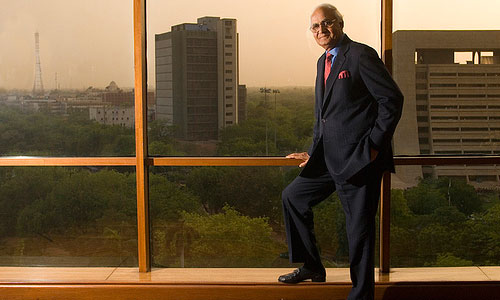

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.

DLF’s Chairman K P Singh has said that RBI’s monetary policy should not stunt the growth of real estate sector and uninterrupted access to affordable finance is vital for this business.

High input and interest costs have already had an adverse impact on profits of DLF in the last fiscal 2011-12, while the entire real estate sector has faced formidable challenges due to global and domestic factors, Singh said.

“In my view, care should be taken in formulating monetary policies to ensure that tightening of credit aimed at combating inflation does not have the unintended side-effect of stunting the growth of the real estate development industry,” Singh said in his annual letter to shareholders.

“Uninterrupted access to affordable finance is vital for the health of the urban infrastructure and housing sector,” DLF chairman said.

Interest costs have increased significantly in the country in past couple of years, as the Reserve Bank of India (RBI) has cut its policy rates just once (in April 2012) after as many as 13 hikes since March 2010.

“During the year gone by, higher input and interest costs resulting from continuing high inflation had an adverse impact on profits,” Singh said, while adding that DLF has managed to maintain operational stability with its strong market position and low-cost land banks in prime locations across India.

DLF recorded a marginal increase of one per cent in its revenue to Rs 10,224 crore in 2011-12, while net profit plunged 27 per cent to Rs 1,200 crore.

The company said that its profits were adversely impacted due to higher input cost with higher constructions costs due to continuing high inflation.

“At a time when Indian economy is experiencing a slowdown due to global and domestic turbulence and policy formulations aimed at curbing inflationary pressures having a depressing impact on productivity and growth, the real estate sector too is faced with formidable challenges,” Singh said.

Singh said that the company has put in place prudent corporate strategies to mitigate risks by off-loading non-core assets and focusing on its strengths.

DLF unlocked Rs 1,774 crore during 2011-12 by divesting certain non-core assets, which included hotel plots, SEZs and IT Parks.

“It is my firm belief that the housing and construction sector is poised to become the next big driver of growth in India … With linkages to more than 250 ancillary industries, the housing and urban infrastructure sector has a major multiplier effect on the entire economy,” he said.

DLF has said in its annual report for 2011-12 that the current economic and business environment are expected to stay challenging over the next few quarters.