By: Subash Bhola, Senior Manager – Research, Jones Lang LaSalle India

By: Subash Bhola, Senior Manager – Research, Jones Lang LaSalle India

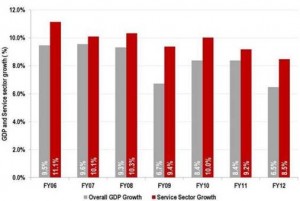

Track2Realty-JLLI: Recently, the annual GDP number (6.5% GDP growth during FY April 2011-March 2012) released by the Reserve Bank of India resulted in a negative sentiment throughout the real estate industry. Consistent with this, in 1H12, the demand for commercial real estate moderated on the back of office occupiers that remained cautious about their expansion plans.

However, the economy’s service sector has still experienced strong growth and is advancing at a rate of 8.5% in FY12. This indicates that a major slowdown in office real estate demand is not likely to occur – the service sector generates the highest demand for office space in the country.

Over the years, the service sector has been the growth engine of the Indian economy. Its growth rate has outperformed the overall growth rate of the country’s GDP, which includes the service, agricultural and industrial sectors – the three major sectors of the economy.

The service sector is comprised of the following industries:

- Banking, financial services and insurance (BFSI)

- Information technology

- Consulting

- Trade, and

- Communication

These are the major drivers of demand for commercial real estate in the country. The service sector has also been one of the country’s core sectors over the past decade, as its contribution to GDP has significantly increased from 50% in FY96 to 63% in FY12. In FY12, when all other sectors (including industrial and agricultural) performed very poorly at an average of 3.1%, the service sector recorded a healthy growth rate of 8.5%.

Overall GDP and Service sector growth of India

Source: Reserve Bank of India

(Note: Overall GDP growth is the average growth of all sectors of the economy including service sector as a component.) FY06 indicates financial year that starts on April 2005 and ends on March 2006.

It is estimated that in 2011, the service sector accounted for about 70% of the demand for commercial office space in the seven major Indian cities – Mumbai, NCR-Delhi, Bangalore, Chennai, Hyderabad, Pune and Kolkata – with the remaining 30% coming from manufacturing and other industries. In the service sector, the IT/ITeS and BFSI industries contributed the most at 35% and 16% respectively.

Over the years, consulting services have shown strong office space demand, which has grown from nearly 3.8% of the total demand in 2009 to 13% in 2011. Therefore, the growth of commercial real estate demand depends principally on the growth of the service sector.

The slowdown in GDP growth in FY12 can mainly be attributed to high interest rates, inflation and a significant contraction in industrial production. However, the growth in the service industry, at 8.5%, has been robust enough to support overall GDP and the sector itself. The IT/ITeS sector, which is one of the major constituents of the service industry, recorded a growth rate of 13% in FY12 and is expected to grow at a similar rate during the next financial year.

Additionally, the BFSI industries registered a robust growth rate of 10% in FY12. Although the manufacturing and industrial sector is performing poorly now, the continued health of the service sector is likely to compensate for it by contributing a larger share.

The Reserve Bank of India projected that the Indian economy would grow at 6.5% in FY13. As compared to many major world economies, this growth rate is fairly healthy; in addition, an established service sector should help India resist any slowdown in office real estate demand.