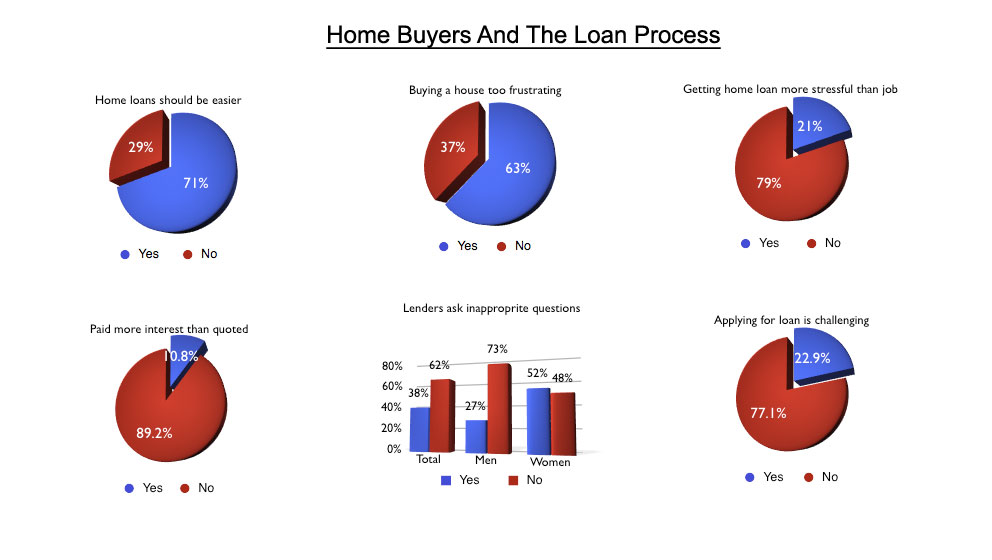

While buying a house two out of three Indians (70.6%) demand a simpler, more understandable home loan procedure. Three out of five home buyers (63%) find today’s house buying process so confusing that they experience high levels of stress and frustration accompanied by distrust. One in five recent home buyers (20.9%) said waiting to hear if they were approved for a home loan was more stressful than waiting to hear if they get a job. One in ten borrowers (10.8%) report their lender gave them a higher interest rate than what they were originally quoted. Nearly two out of five (38%) said their lender asked for inappropriate information. Almost twice as many female buyers (51.7%) as male buyers (26.4%) said they were asked for inappropriate information.

While buying a house two out of three Indians (70.6%) demand a simpler, more understandable home loan procedure. Three out of five home buyers (63%) find today’s house buying process so confusing that they experience high levels of stress and frustration accompanied by distrust. One in five recent home buyers (20.9%) said waiting to hear if they were approved for a home loan was more stressful than waiting to hear if they get a job. One in ten borrowers (10.8%) report their lender gave them a higher interest rate than what they were originally quoted. Nearly two out of five (38%) said their lender asked for inappropriate information. Almost twice as many female buyers (51.7%) as male buyers (26.4%) said they were asked for inappropriate information.

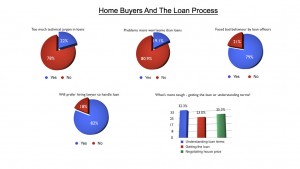

Adding to the confusion, nearly one-quarter (22.9%) said applying for a loan was challenging because documentation requirements from their lender kept changing. One in five borrowers (21.6%) said their lender used too much technical jargon, and 20.7% said finding a lender that was easy to work with was challenging. Borrowers considered these particular problems more challenging than the amount of time it took to fund a loan (19.1%). Behaviour of lending agency staff has been cited as the most humiliating experience by the loan seekers with 79% saying they would never go to the same bank for future loan. A substantial number of those who have been through the grinding of securing home loan, as many as 82%, say next time they would prefer to engage and pay a lawyer’s fee for the due diligence than be at the receiving end of lenders.

These are the findings of the survey conducted by Track2Realty, the real estate market tracker. The survey was conducted in ten cities among those who have either bought a house in the last three years or are planning to buy now. 52 per cent of the respondents were male and 48 were female. The survey was conducted in Delhi-NCR, Mumbai, Kolkata, Chennai, Lucknow, Bhopal, Bangalore, Jaipur, Patna and Ranchi.

These are the findings of the survey conducted by Track2Realty, the real estate market tracker. The survey was conducted in ten cities among those who have either bought a house in the last three years or are planning to buy now. 52 per cent of the respondents were male and 48 were female. The survey was conducted in Delhi-NCR, Mumbai, Kolkata, Chennai, Lucknow, Bhopal, Bangalore, Jaipur, Patna and Ranchi.

A sample size of 2000 was taken for the study and the respondents were carefully selected amongst those who have either got a home loan in the last three years or have applied for the same now. Face-to-face interviews were conducted where a set of structured questionnaire was given to them. The process was an attempt to understand the intricacies of getting a home loan and the home buyers’ dilemma, even though banks and financial institutions overtly try to reach for this TG.

The survey also found that understanding the loan process and coping with lenders’ requirements are the most challenging aspects of getting a loan today. In fact, survey respondents ranked it more challenging (32.3%) than getting the loan itself (23%) or negotiating the sale price on the home (25.3%). In addition, three out of four (79%) recent homebuyers, especially those earning Rs.50,000 a year or more, report getting a loan was as, or more, difficult than they expected.

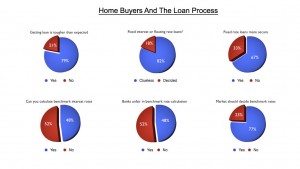

The question of whether to go for fixed rate loans or floating rate loans is something that bothers nearly all of the home buyers.  More than eight out of ten, 82%, are clueless till the eleventh hour. Interestingly, despite the fact that fixed interest rate loans are priced higher than floating rate loans for a similar tenure, fixed gives a sense of security to 67% of the prospective home buyers. More than half the home buyers, 52%, do not really understand how to calculate the interest rate that is linked to a benchmark rate.

More than eight out of ten, 82%, are clueless till the eleventh hour. Interestingly, despite the fact that fixed interest rate loans are priced higher than floating rate loans for a similar tenure, fixed gives a sense of security to 67% of the prospective home buyers. More than half the home buyers, 52%, do not really understand how to calculate the interest rate that is linked to a benchmark rate.

Moreover, they are not comfortable with different banks using different methodologies for the same. Some banks use their ‘prime lending rate’ (PLR) as the benchmark rate. Some banks have a specific benchmark rate that they use for home loan purposes. 48% of the home buyers, who understand the intricacies of benchmark rate calculations, blame the banks for unfair rate calculations. Majority of them, 77% believe that ideally the benchmark rate should vary exactly as per the market conditions. But it rarely does and while it is quick to go up but rarely shows the same alacrity while going down).

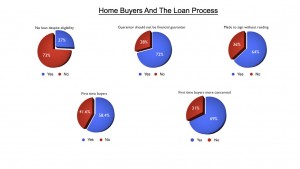

In spite of frustrations and confusion, many recent buyers that participated in the Track2Realty survey said they successfully secured loans and purchased homes in the past three years. Most were highly qualified buyers, with just over a quarter (27%) reporting their loan has not been sanctioned despite of fulfilling the criterion and having no history of any loan default. More than seven out of ten, 72% demand that a guarantor should not be automatically financial guarantors. A majority of them, 64% complain that they along with the guarantor had to sign a bunch of booklet and they did not get a chance o read it.

This survey is a wakeup call for the banks and other home finance institutions. It clearly points to the fact that borrowers want a process that’s easy to understand and follow. They don’t want surprises and they want to be able to depend on their lender. For most people, the home buying process isn’t about the loan; it’s about getting a home. While banks and other lending institutions spend a lot on advertising, they hardly do an audit check over the lending procedure; it’s disconnect with the loan seekers and the attitudinal problem of their own staff.

The survey found strong evidence confirming first-time buyers will continue to be an important group in the next 36 months. According to the survey, three out of five (58.4%) Indians planning to purchase a home in the next three years identify themselves as first-time buyers. At the same time, the survey found first-time home buyers are significantly more concerned, as many as 69%, than other buyers about the problems they face in getting a loan today.