Unlisted real estate firms more hit by piling debt

While the piling debt of the listed real estate companies has hit the headlines throughout the year 2011, the debt of the unlisted realty companies today stands at Rs.15 trillion.

While the piling debt of the listed real estate companies has hit the headlines throughout the year 2011, the debt of the unlisted realty companies today stands at Rs.15 trillion.

Continuous rise in interest rates by the banks is dampening the effort of the real estate companies to reduce debt by selling non-core assets.

The 12th edition of Track2Realty BrandXReport 2023-24 is witness to the fact that the fiscal performance of nearly all the large & listed players is at an all time high. The real estate leadership is hence defined by the consumer experiences and their shared satisfaction along with the aspiration for the respective brands in the business.

Bengaluru-based Prestige Group has emerged as the National Brand Leader for the 2nd consecutive time. As a matter of fact, all the Top 3 National Brands of last fiscal year retain their respective Brand Rank with better Brand Score. Out of the Top 5 National Brands, 5 players are yet again from Bengaluru market. Sobha Limited improves its Brand Rank and jumps up to Number 4 this time around.

Recoveries in real estate topped the list, followed by the road sector thanks to several policy interventions, turnaround in these industries as also an overall positive macroeconomic. ”Real estate is seen to recover 77-82% of the acquired debt (by asset reconstruction companies) over eight years followed by highway tolling with a recovery of 58-63 per cent,” the study noted.

Post Covid, the Indian real estate is witness to a K-shape recovery where the listed & larger players are increasing their market share at the cost of smaller ones. Prima facie, what sounds like a market-linked reform, have concerns & repercussions that run much deeper. Is the current criterion of assessing a market with fiscal performance justified? Can only a handful of branded developers be the answer to India’s housing woes, questions Track2Realty.

Ramneek Sethi, an IT professional wanted to invest in the stock market. He was keen on real estate stocks keeping in mind its growth potential and India’s increasing urbanisation. However, a meeting with the financial planner changed his mind. The financial planner categorically asked him to stay away from volatile real estate stocks and instead get into the power play through proxies in cement, steel, and other ancillary businesses. Reason: Real estate stocks are not just volatile, but more often than not even defy the principles of fundamental analysis and technical analysis.

There is no denying that the real estate stocks have always been high in demand for investors. After all, in a housing deficient country like India it has to constantly grow. Isn’t it? However, what is often intriguing is that some of the real estate stocks have much higher price point, compared to the industry peers with similar fundamentals, including the EPS and PE ratio. This raises a fundamental question as to what determines the price of the real estate stocks.

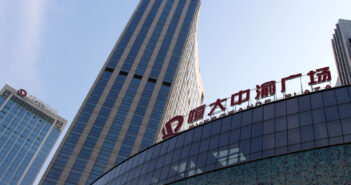

Within the built environment of the Indian real estate there is still denial about too many parallels between the Indian and the Chinese real estate. Many even believe that the Indian economy is not that real estate dependent as the Chinese economy. Even when admitting the crisis in Indian real estate, it is diplomatically wrapped in the developer’s justification of not learning any lessons on part of the Indian developers.

I often get amused when I get into the details of the industry survey that shouts at the top of its voice – “All is Well”. Some of these industry reports claiming the business to be witness to higher consumer sentiment are based on the feedback of connected parties like developers, banks, financial institutions and private equity players. All in all, it’s a family cycle where everyone is desperate to beg, borrow or steal for sale. The most important stakeholder – the home buyer – whose sentiment is being tracked is better left out in this mutual appreciation club of vested interests.

Will the festive season of 2021 change the course of real estate is something that most of the analysts are curious to see. The festive season has just started and it is too early to guesstimate the exact sales volume & value growth at this point of time. But with a closer look at the Indian housing market one can probably vouchsafe that there are more catalysts of optimism than pessimism. How far this optimism is sentiment driven and to what extent the economic fundamentals support the business take-up is something that needs to be evaluated.